Eight Steps for Creating the Ultimate Moving Budget

Moving soon? Get organized with our free moving checklist.

Moving is complicated and can become expensive quickly without planning ahead. Of course, there are a lot of factors that go into creating a moving budget and figuring out how much your move will cost. On average, a renter can expect to spend $1,000 – $3,000 on a move. For homeowners, that number can be even higher, averaging $8,000 to $11,000.

By paying attention to detail and being proactive, you can create a moving budget that will help alleviate some of the stress that comes with this daunting process. Here’s how.

Step 1: Take inventory

Before you do anything else, determine what’s moving to your new home. Everyday items like clothes, kitchenware, and furniture will be on your inventory from the very beginning, but go room by room to ensure you don’t miss anything. By doing this, you can make the right accommodations to fit your needs.

Step 2: Do your research

Having a clear idea of what’s going to your new home also helps you know what kind of movers you need. Professional movers will need your inventory to provide estimates or quotes. These estimates are based on various factors including what’s being moved and where it’s being moved to. Here’s what to expect:

- Base moving fee: Moving companies start out with a base rate. This is the amount that all their customers pay regardless of how much “stuff” is being moved.

- Specialty items fee: Things like pool tables, safes, pianos, and artwork are considered “specialty” items by moving companies. This means that they will likely charge an extra fee to move them because of how fragile or difficult they are to move.

- Moving insurance: Moving companies offer clients something called valuation which acts as insurance for your belongings. You are compensated if the company damages or loses your things. Companies won’t charge you for basic coverage but will do so for options with more protection.

Here’s a list of questions you should ask moving companies before you choose one. This will help you pick the best company for your move.

If you choose to move on your own, there are still fees you have to consider:

- Truck rental: There are a few things to remember when renting a moving truck, including how far you will be driving and what size truck you need.

- Equipment rental

Here are some costs to consider when creating your moving budget regardless of how you move:

- Storage: Storage units come with monthly fees and you will have to buy your own lock. Depending on the company, you might also have to pay a security deposit. The deposit covers the cost of the storage company cleaning the unit if you fail to do so. If you clean the unit yourself, you get your money back.

- Transportation: This doesn’t apply if you are driving a rented moving truck. But if you’re letting someone else drive the truck, you need transportation of your own. Gas is especially important to factor in a budget for long-distance moves.

Step 3: Decide when and where you want to move

Believe it or not, the time of year you decide to move alters how much your move costs. Expect to pay more if you’re planning to move during the summer. Fewer people move in the winter because it’s cold and moving in the snow is no easy task. Plus, it’s easier to move with kids in the summer since they won’t be in school.

And, of course, where you’re moving impacts how much a move will cost you. If you’re moving from a more rural area to a big city, the cost of living will be higher than moving from a city. Some U.S. cities also require a moving permit to park moving trucks. Without one, you will be fined.

Step 4: Put money aside for everyday expenses

Unfortunately, life won’t slow down while you’re moving. Kids have school, dogs have to be walked, and groceries have to be bought. You have to pay for all these and more while financing your move. Start by tracking monthly expenses and subtracting this amount from your income after taxes. This is the money you will divide between your moving budget and other expenses.

Step 5: Find ways to save and earn money

When creating your moving budget and to help afford your move, consider cutting back on spending where you can. If you’re someone who loves to go out to eat, like many of us are, buying groceries and recreating your favorite restaurant dishes is an enjoyable way to save money. Freeze those leftovers for lunch at work the next day. Instead of buying new clothes, wear the options you already have in new ways. It’s a quick way to freshen up your wardrobe and get a new outlook on your clothes.

How you choose to save money is up to you, but how much money you save makes a difference in the quality of your moving experience. Plus, there are plenty of other ways to save money or make some. Having a yard sale or buying in bulk puts some money back in your pocket.

Luckily, some moving supplies cost little to nothing. Get recyclable plastic bins delivered to you for a low price or cardboard boxes for free. Use things like towels and old clothes to wrap breakable items you’re moving and move your dressers without taking clothes out of them to save time and space. There are so many hacks that help you save money while moving.

Making attainable savings goals is also important. Many banking apps now have features to automatically deposit money from checking to a savings account. Consider opening a separate saving account for your move to keep things organized. And having a separate account for your moving budget helps protect you from spending the money on other things.

If you’re having trouble affording everything your move requires, opening a credit card could be the right option for you. Or, there are also small loan options available. Both options give you the breathing room to focus on your move without the stress of paying everything back right away.

Step 6: Have an emergency fund

Depending on your financial situation, it can be difficult to create an emergency fund. If you’re in the position to have one, it’s smart to have some amount of money set aside for the unexpected. Moving comes with some curveballs. Financial experts say emergency funds should be able to provide for at least three months worth of expenses.

Step 7: Factor in additional costs

These things won’t apply to everyone, but they are important to consider if they apply to you. Here are some questions to ask yourself to make the best financial choices during your move:

- Do you need to professionally clean your old home (maybe to get your security deposit back) or your new home?

- Do you have kids? Do you need to pay for childcare?

- Do you have pets? Do you need to pay for pet care?

- Do you have houseplants? Who’s moving these plants?

- Are you taking time off of work to move? How long will you be off work? How does this impact your moving budget?

Step 8: Save space in your budget for breathing room

Having a moving budget doesn’t mean you’re putting every penny you have into a savings account. Make room when creating your moving budget to enjoy yourself, as moving is stressful enough! You might need a distraction from it all – perhaps a walk in the park or spending the night in with your favorite snacks, some friends, and a good movie!

Moving soon? Get organized with our free moving checklist.

Internet and TV tips

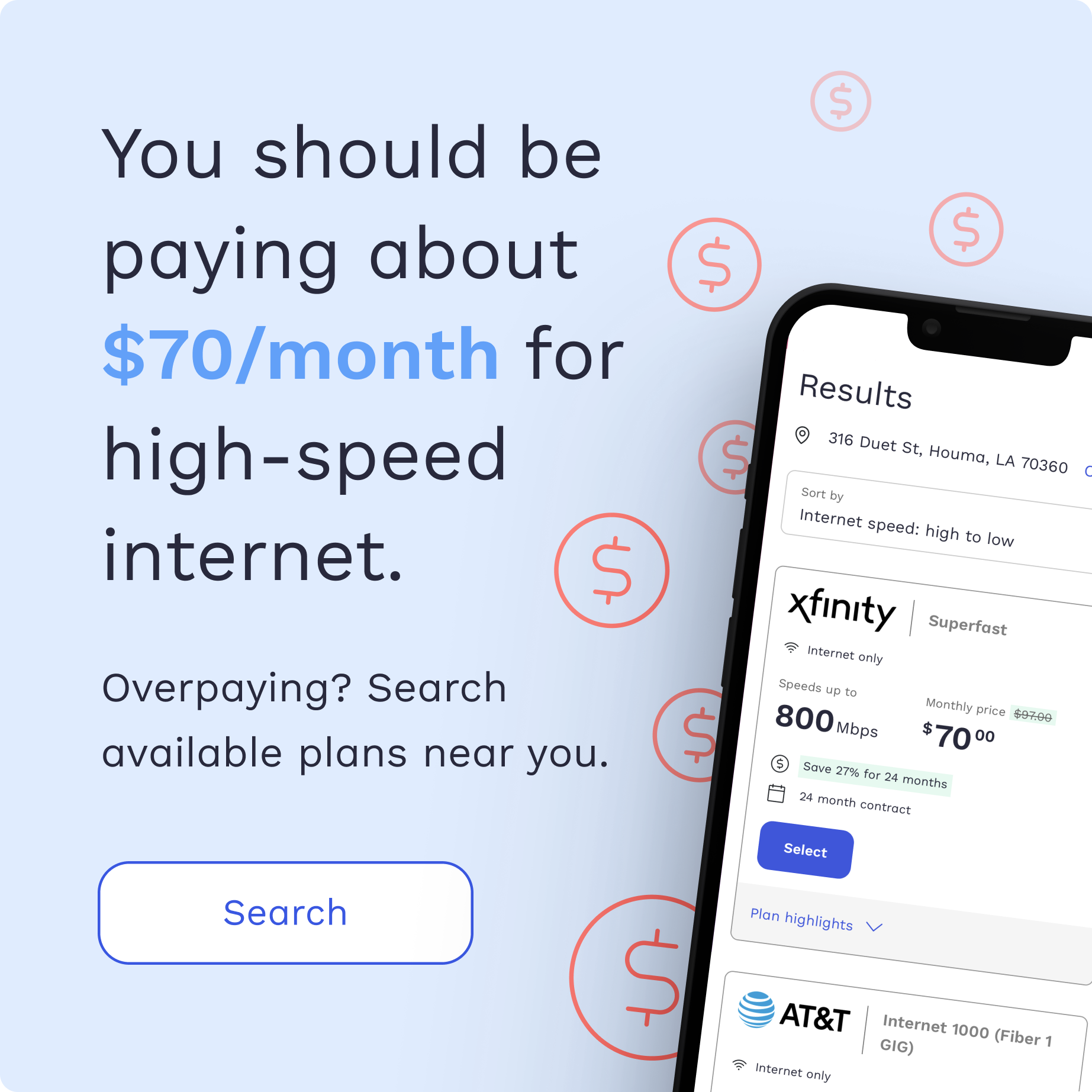

Switching providers and don’t know where to start? We can help.