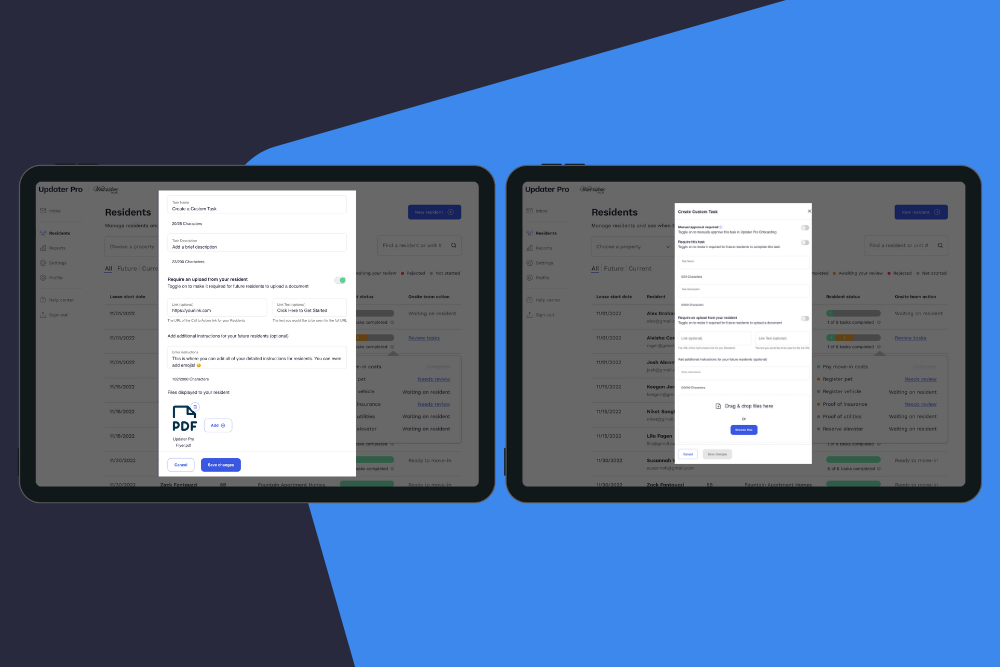

Clinton vs. Trump: Effects on the Housing Market

Come election season, everyone has an opinion. But whichever way you lean politically, it’s not easy to find your footing on one topic in particular this year: the housing market. With the help of Zillow’s panel of economic experts and Trulia’s survey of the American public, we’ve broken down some of the expectations, concerns, and possibilities for the U.S. housing market as we near political infamy on November 8th.

Policy, predictability, and economic growth

This summer, Zillow asked over 100 U.S. real estate experts, academics, and economists to discuss the effects of a Donald Trump or Hillary Clinton presidency in relation to the housing market. Survey says…

Only 16 percent of Zillow’s panelists said that Trump would have a somewhat to very positive effect on home values, whereas 45 percent said he’d have a somewhat to very negative effect on them. For Clinton, results were reversed. Thirty-three percent said that a Clinton presidency would have a somewhat to very positive effect on home values, while only 16 percent said she would have a somewhat to very negative effect on them.

Why the negative expectations for Trump? Experts cited Trump’s lack of political experience, inconsistent policy stances, and general unpredictability as much of the reasoning. Meanwhile, Clinton’s pro-housing policies and inherent connection to her husband’s economic success in the ‘90s both boded well for Zillow’s panelists. But it wasn’t all positive for Clinton; some panelists expressed concern over the likelihood of Clinton adding regulatory hurdles, and their subsequent impact on economic growth.

Economists vs. the American court of public opinion

Trulia took a more liberal (no pun intended) approach with their own survey. Rather than ask economic leaders for their insights, they asked a sample of the American public — namely, 2,034 U.S. adults, all 18 or older — for their thoughts on the same subject.

People were asked what would likely happen to home prices under either presidential candidate. Thirty-nine percent said housing prices would rise a little or a lot under Trump, whereas 29 percent said the same of a Clinton presidency. Nearly half of Democrats surveyed (47 percent) said housing prices would likely rise under Trump; only 24 percent of Democrats said the same about Clinton. It was a considerably closer call for republicans; 38 percent said home prices would rise under Clinton, while 33 percent said the same under Trump.

Thirty-four percent of independents said housing prices would rise under Trump, compared to 28 percent under Clinton. Most other groups surveyed (e.g., unmarried respondents, renters, and millennials and younger votes) were all more likely to believe housing prices would rise under a Trump presidency. Of those surveyed, millennials and younger voters had the largest margin: 49 percent (Trump) to 26 percent (Clinton).

Knowledge is power… when you can get it

Of course, these are opinions. Whereas Zillow focused on which candidate would have the most positive overall effect on the housing market (the answer: Clinton), their panel didn’t specifically cover whether that “positive” effect meant higher or lower housing prices. For the Trulia crowd, things get dicier… mainly because the public doesn’t seem to have much insight into either candidate’s stand on housing during this election.

Clinton’s campaign site specifically outlines a $25B investment in housing. Her plan includes a federal match of up to $10,000 for savings going toward a down payment for people who earn less than the median income in their area and a focus on “lifting more families into sustainable homeownership and connecting housing to opportunity.” In theory, one might imagine that ideology doesn’t lend itself to higher home prices. And if you search Trump’s campaign site for his position on housing, you won’t find anything.

Tax proposals could be the deciding factor

In the past 3 debates, the housing market hasn’t been a popular talking point for Trump or Clinton. It’s not surprising though, as Ralph McLaughlin, Trulia’s chief economist, says, “Eight years ago, housing and the economy were the main talking points of Obama and McCain because millions of homeowners were going through foreclosure and the economy was in shambles.”

While the same can’t be said for the U.S. economy today, the issue of homeownership could fall on tax proposals. Whether it’s reducing the value of itemized deductions or increasing the standard deduction, both Clinton and Trump could make owning a home less appealing to the American public. As Russ Wiles reported earlier this month for USA Today, it’s these kinds of tax proposals that could limit the ability of some homeowners to deduct mortgage interest and property taxes.

As luck would have it, you can still vote for Updater this election season… to win the coveted 2016 AMSA Summit Award!

More Industry Insights

Five leadership lessons multifamily can steal from sales (courtesy of Kevin Ducey’s conversation with Tony Sousa)

15 December 2025

What great sales leadership can teach multifamily about resident satisfaction

15 December 2025