Millennial Homeownership: What You Need to Know

Did you know that millennials are the largest group of first-time homebuyers currently on the market? Even so, millennial homeownership comes with a unique set of challenges. Plus, this generation is specific about what they want from a home when they do decide to make that purchase. We’re here to tell you what obstacles millennials face, what they want from a home, and how you can help. And since millennials are powering today’s housing market, you won’t want to miss this!

Millennial Homeownership: The Cold, Hard Facts

You’ve probably heard a lot of things about millennials. They’re famous for loving avocados, posting every meal they eat on Instagram, and taking selfies at inopportune moments. Maybe you’ve also heard that millennials don’t care about starting families, that they still live with their parents, and that they have no interest in settling down? This, however, is simply not true.

Though the tweets about avocados and millennials are hilarious, the data shows that millennials are actually interested in the same things that previous generations were: security, stability, and for many, homeownership. So do you want to help this generation find their dream homes? Let’s get down to the cold, hard facts about millennial homeownership.

Are millennials even buying?

Homeownership rates overall are up from 2017, with the homeownership rate in 2018 sitting at 64.2%. Regardless of the stereotypes, millennials are positively impacting this rate, with their homeownership rate reaching a high of 36% in 2017. This rate dropped slightly in early 2018, but overall, millennial homeownership is on an upward swing. However, other generations still beat out millennials, with 35-44 year olds owning homes at a rate of 58.9% in 2017.

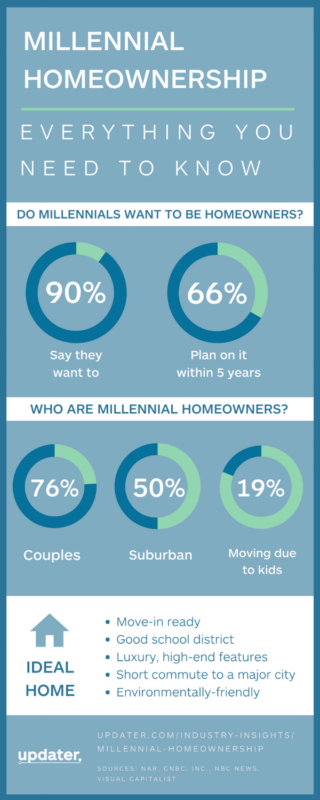

Millennials make up a massive 66% of all first-time homebuyers and 34% of homebuyers overall. Though their numbers are still small, 90% of millennials say they want to eventually purchase their own home, and almost 70% plan on buying a new home within the next five years, which means that millennial ownership is only going to increase in the years to come. As this huge group of first-time buyers starts to hit the market, they’re going to make a big impact.

Which millennials are investing in homeownership?

Many millennials have delayed ownership, choosing to rent while they complete their education and become stable in their career. Now, older millennials who have started families, or who are finally ready to settle down, are becoming homeowners.

Over 70% of millennial homeowners are couples, and 64% of those couples are married. Twenty-five percent of millennials cited marriage as a reason for becoming a homeowner, while 19% said the birth of a child was a primary factor.

However, married millennials aren’t the only ones buying homes. Single females make up a significant percentage of millennial homeowners. In 2017, 60% of millennial women listed as the primary borrower on a mortgage were single. This is a growing trend among homebuyers of all ages. In 2017, 17% of homebuyers were single women.

Overall, many millennials are buying homes because they are coming up on milestones like career success and marriage. Some millennials, though, simply want more space, more equity, and backyards for their pet dogs.

Millennial Homeownership Trends: What They Want in a Home

As the effects of the Great Recession recede, millennials who previously felt the pressure to rent apartments in urban centers and commute to work, are now moving to the suburbs. Currently, only 25% of millennials live in urban areas.

When it comes to purchasing a home, millennials care a lot about location. Though many want to be in the suburbs, they also want to be near major cities and in top school districts.

Some of the most popular cities for millennial homebuyers are:

- Des Moines, Iowa

- Pittsburgh, Pennsylvania

- Buffalo, New York

- Lansing, Michigan

- Fort Wayne, Indiana

- Minneapolis, Minnesota

When it comes to homeownership, millennials overwhelmingly prefer move-in-ready homes. They are looking for reliable homes where they won’t have to worry about maintenance issues and upkeep. Millennials also care about having luxury and high-end features:

- 75% want new appliances: fridge, oven, dishwasher, washer/dryer

- 64% want large master bedrooms with walk-in closet space

- 46% want luxury kitchens and high-end cabinetry and countertops

- 45% want solid hardwood or stone flooring throughout

- 47% want some sort of solar panels or energy storage

After finding their dream home, however, millennials still face a few challenges.

Homeownership and Millennial Buying Habits

When it comes to millennial homeownership, this generation faces some obstacles. About 42% of millennials have debt from student loans, with an average monthly payment of $351. Plus, millennial salaries remain disproportionately low. However, 86% of millennials still say that owning a home is a good investment, and 66% plan on buying a home in the next five years.

Though many millennials have debt, this generation is not as bad off as some may believe. In 2016, millennials cut their overall average debt by 8%. By paying back student loans, keeping credit card debt in check, and other measures, millennials actually managed to increase their credit scores by an average of four points in 2016 — the most of any generation.

Additionally, millennials who have waited to buy have had time to save for a home over several years or alongside a significant other, giving them the ability to put down a decent down payment. Seventy-two percent of millennials make their down payments from savings, while 25% of millennials receive a gift from a relative or a friend to help finance their home purchase.

However, even with savings and help from others, millennial homeownership rates in major cities like New York City and Los Angeles are low. Rates in more affordable cities in the Midwest and the South are far higher. In fact, almost 50% percent of millennial homeowners now live in the suburbs.

In early 2017, 35% of millennials financed their homeownership via Federal Housing Administration mortgages. These mortgages offer low down payment percentages with flexible requirements when it comes to credit scores, making them a great option for many millennials.

However, others in this generation don’t necessarily need FHA mortgages. The number of millennials closing with conventional mortgages is increasing (63% as of June 2017), and the number of FHA loans made to millennials is steadily decreasing.

What Millennials Need From Real Estate Agents

When it comes to homeownership, millennials are more likely to rely on real estate agents than other generations. And even though 88% of millennials use the internet to research during the hunt for a new home, many still rely on real estate agents for recommendations and guidance through the searching and buying process.

So what can you do to help out millennials seeking homeownership?

Be informed about unique millennial challenges.

Whether it’s student debt, bad credit, or just a lack of knowledge about real estate, know who you’re working with. Millennials face unique obstacles when it comes to homeownership, but you have a great opportunity to help them navigate.

Andrea Barone, a Client Success Coordinator at Updater, gave this advice for real estate agents who are working with millennials:

For most millennials, purchasing a home will be the single largest investment they’ve made outside of their education. A real estate agent should be extremely knowledgeable in all aspects of home buying, from the value of the property and the surrounding area to the actual ins and outs of the purchasing process.

Provide resources and be present online.

Since most millennials do their research online, make sure you have an outstanding website. Write an engaging and consistent blog about all the ins and outs of home first-time home buying and have an active social media presence. Also, take advantage of innovative software and apps to make millennials feel cared for and as informed as possible.

On your website, include resources aimed specifically at millennials. Remember, they’re the biggest group of homebuyers on the market right now! You could offer educational material on everything from how to build better credit to what kind of loan to consider. Ultimately, the key is to be prepared to answer lots of questions and help millennials through an exciting process.

Key Takeaways on Millennial Homeownership

Millennials are actively seeking homeownership.

- 36% of millennials are already homeowners

- Millennials are 66% of all first-time homebuyers

- 66% of millennials plan to purchase a new home in the next five years

In a home, they’re looking for something affordable and ready-to-move-in.

- Suburban community

- Luxury, high-end features

- Environmentally friendly

- Top school districts

- Relatively short commute to a major city

Leverage your online and social media presence to meet the needs of millennials.

- Be active on social media

- Establish yourself as an expert by blogging

- Answer questions upfront by providing educational resources

Want to keep these points in mind as you work with millennials? Print this infographic and hang it by your desk or download it to your phone. And don’t forget to help your coworkers and agents out by sharing the infographic with them!

Resources: United States Census Bureau, National Association of Realtors, Medium, Time, NBC News, USA Today, Inc., CNBC, Forbes, HousingWire, Bloomberg, Visual Capitalist, Bankrate, Student Loan Hero, The Mortgage Reports, Washington Post, Harvard Kennedy School, SmartAsset