Ellie Mae’s Borrower Survey: Mortgage Must-Do’s

Dear loan officer,

I’m thrilled that you welcomed me into your industry. It means that you believe I have something to contribute — something to bring to the table. That means the world to me. But I’m having a moment; I’m upset and I’d like to share why.

Please let me begin by setting the stage:

- I’m a millennial. But don’t bucket me in with the 75.4 million other millennials out there. I’m a snowflake. I’m unique.

- I bought my first home 2 years ago. It was a co-op studio in Manhattan. The process was about as bad as you might imagine. (In case you’re curious why, my experience was documented by REAL Trends.)

- At the time, I couldn’t choose a loan officer. I couldn’t tell the difference between the 2 that were recommended by my realtor. I ended up flipping a coin. Seems like a pretty big decision for a coin toss.

- I like technology. It makes my life easier — more streamlined. Why wouldn’t I want to leverage it during the most terrifying purchase decision of my life?

I recently read Ellie Mae‘s latest Borrower Insight Report, and you should too. Here — I’ll make it easy for you.

Key takeaways from the report

The report is a high-level analysis of a survey that the company conducted with over 3,000 homeowners and renters between the ages of 18 and 70. In a nutshell, the findings are logical:

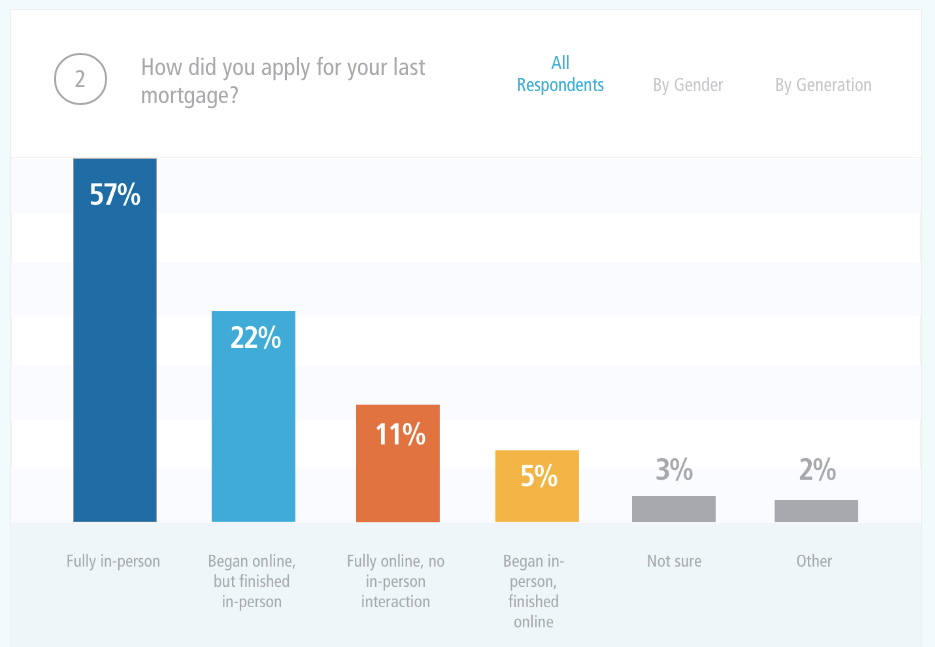

- Over 1/3 of homeowners applied for their most recent mortgage using a combination of online and in-person or applied completely online.

- Unsurprisingly, millennials were the most likely generation of homebuyers to begin their application online and finish it in person.

Think about that for a moment. Technology is playing an increasingly larger role in your job by the minute. What are you doing about it?

The survey also found that today’s millennial homebuyers (who have many more homes to buy in the future!) most often cited security as the most important factor when applying for a loan online. Not only do borrowers want to apply online, but they want the technology behind the technology to be solid! What are you doing about that?

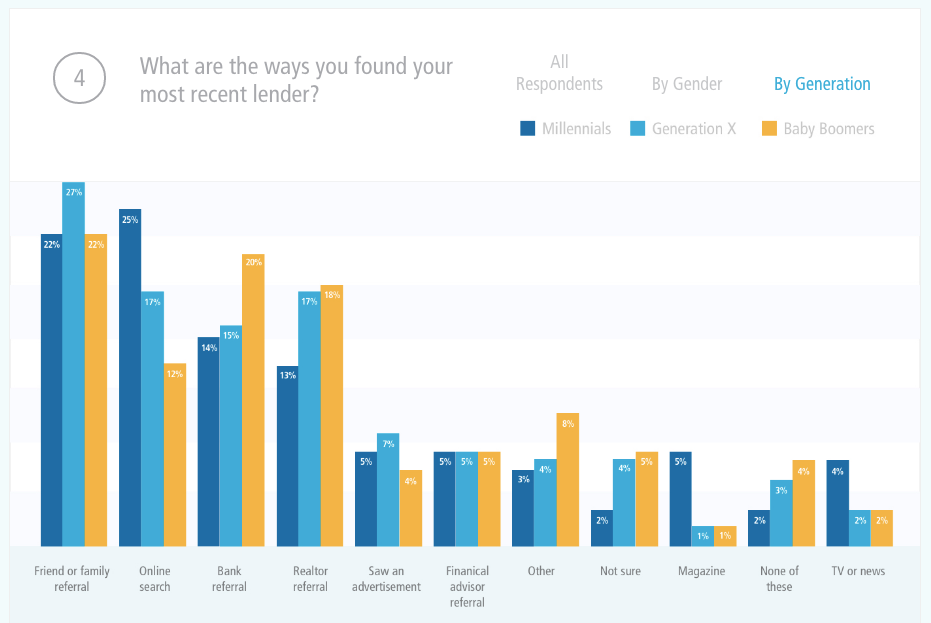

The survey also asked borrowers how they discovered their lender.

- Referrals are still #1.

- 23% of participants (the largest cohort) chose their last lender based on a referral from a friend or family member.

- When you analyze by generation, 25% of millennials found their most recent lender based on online search. Think: do you come up as one of the first 3 Google results?

My frustrations with these findings

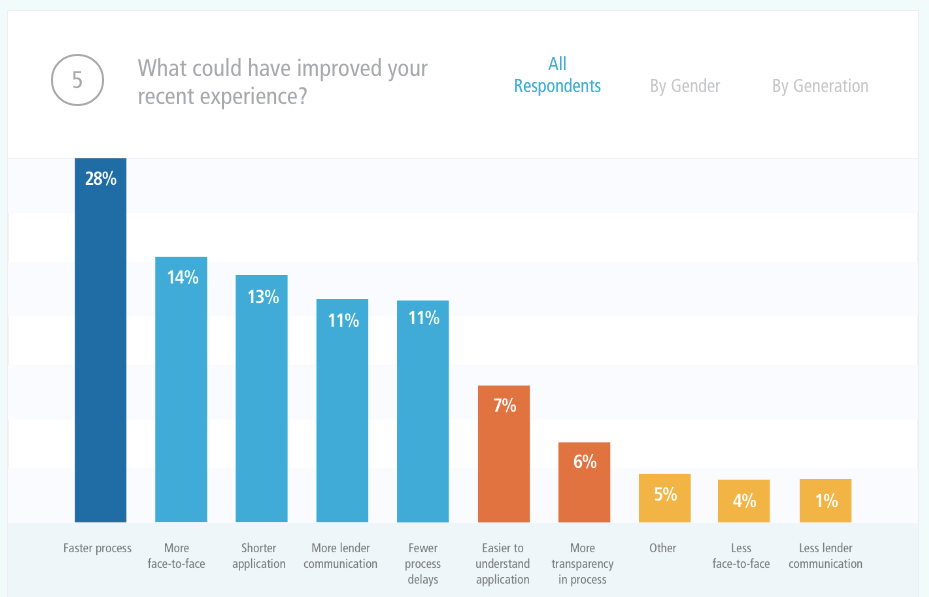

Consumers are demanding more, yet I haven’t seen individuals step up to the plate to change things for the better. They crave more safety, more streamlined processes, and greater speed.

I loved being able to buy my home. It’s the American Dream. But the process was gruesome. I wanted answers. I wanted someone to hold my hand. I wanted to know where I was in the process — step 2 or 200? I didn’t know when I should lock. I didn’t even know what locking was.

I’m sad because I’m not seeing many loan officers offer resources and technology to solve these problems. Imagine your profit increase if you actually appeared in the top 3 Google search results. Imagine the referrals that would roll in if you went above and beyond to provide a safe, tech-savvy client experience. Imagine the borrowers who would know you by name and have you on speed dial if you had a differentiator that elevated your service level beyond the competition’s.

Here’s my advice

I know small businesses. I used to run my own small business marketing shop. Here’s what I would do: think of your business as a person, and treat it like you would another human being. Here are several ways to do exactly that:

- Be unique. I mentioned earlier that I’m a snowflake. So is your business. Only you know your market — your unique values, beliefs, and character traits. Only your personal brand has a personality that you built. When you’re building your business, make it you. Be authentic. (Millennials dig that.)

- Know what makes that person tick. If you fall into the bucket wherein your business is driven by referrals 23% of the time, the only thing that will have an immediate impact on your bottom line is driving more referrals. There are technologies and tips that can help you drive more referrals:

- Find a CRM and use it like your business depends on it. In many ways, it does.

- Live in the comments on social media — meaning comment more than you post.

- Let your reputation speak for itself. Show off your testimonials. You earned it, so work it!

- Know what upsets them and solve their problems. It’s called omotenashi — an old Japanese hospitality tradition of fulfilling your customers needs before they ask. Every single borrower (except for refi’s) goes through the exact same experience when it comes to finding a home, financing it, and moving into it. You’ve done this a million times! You know what they need, so give it to them.

- Shameless plug: every one of your clients hates moving. I can help you with that. We offer technology that makes moving easy, safe, and perfectly personalized. That’s what borrowers want, remember? Why not apply the same idea to their actual move? Differentiate. Be unique. Schedule a quick demo with me and I’ll show you how Updater works and we can chat marketing strategies. Sore throat? Watch a quick video on your own.

- Make it a no-brainer to introduce. Give borrowers technology to help them refer (Ambassador, Extole, or Referral Candy are all great choices) or a tangible prompt. Give them a tool that reminds them to refer. A member of my family owns a personal training gym; his athletes have that Greek God, perfectly chiseled physique. So giving them branded shirts, water bottles, and beach towels provides a physical prompt and a natural reminder to refer when asked, “You must have trained hard for that beach bod. Where do you go?” Give your clients a natural prompt — something for their new home that’s easy to discuss when guests come visit.

The home purchase process was rough for me. That’s why I’m giving you something to think about. I want future buyers to win, and now that I’ve joined your industry, I want you to win too.

More survey findings

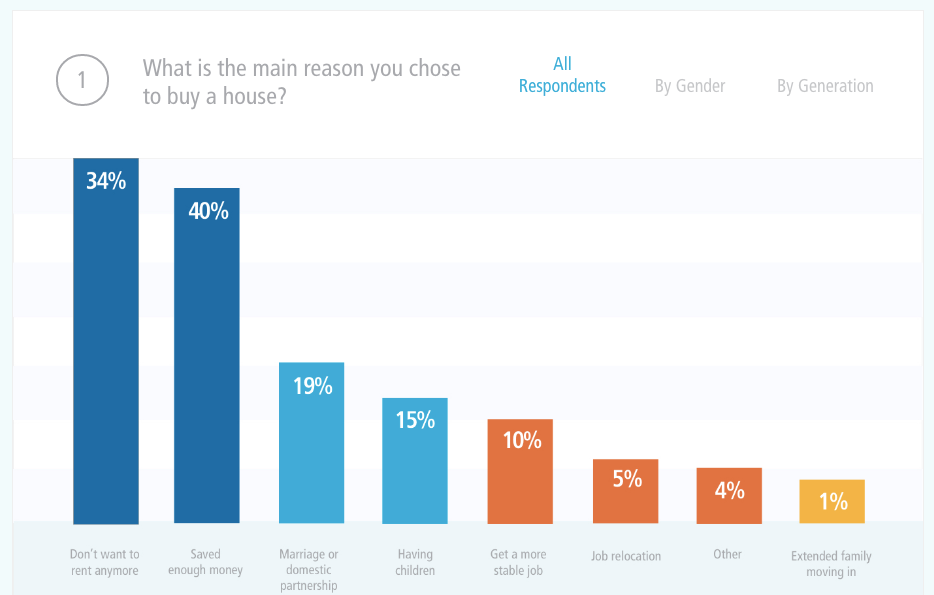

Want more? View the charts below for further insights from the latest Ellie Mae borrower survey.

#block-yui_3_17_2_1_1489725150258_33037 .sqs-gallery-block-grid .sqs-gallery-design-grid { margin-right: -22px; }

#block-yui_3_17_2_1_1489725150258_33037 .sqs-gallery-block-grid .sqs-gallery-design-grid-slide .margin-wrapper { margin-right: 22px; margin-bottom: 22px; }

More Industry Insights

Five leadership lessons multifamily can steal from sales (courtesy of Kevin Ducey’s conversation with Tony Sousa)

15 December 2025

What great sales leadership can teach multifamily about resident satisfaction

15 December 2025